The goal of the project was to offer a life insurance company named INVL a way to get out of the “red ocean” and reach the “blue ocean”.

Background

The challenge at hand seemed simple at first – make more people pay for life insurance. The idea seemed simple as well: why not get life insurance? If something happens to you or a close loved one, the life insurance money that you receive ensures that you won’t be on your back after an accident of some sort. It seemed simple enough to understand that once you have customers, they will probably want to stay for a lifetime. However, as usual, it was not that simple.

More research…

Our course kicked off the course with a presentation from the client. To me, the presentation seemed more like a presentation for selling us life insurance instead of explaining how the company actually works and what life insurance is. We took it upon ourselves to deep dive into all things life insurance, such as company insights, industry analysis, competitive overview, interviews with stakeholders and so much more. We reached the point of lag due to so many sticky notes on our Miro board quite quickly.

After that, we tried to make sense of all the data we had gathered. To do this, I teamed up with my coursemate Zac to create a presentation for the INVL representatives, but at the same time, the whole course started creating small snippets to be put into the presentation. We also created a few affinity maps and, to our surprise, immediately saw many types of personas emerging, such as:

- → a person shying away from insurance & thinking about alternatives, such as investing

- → a procrastinator, who is constantly delaying getting life insurance due to being busy

- → a person with barriers due to life insurance being too expensive for them

- → a person with prejudice against life insurance due to previous experiences

We then presented all our findings to the INVL representatives, who were very eager to learn what we were going to come up with.

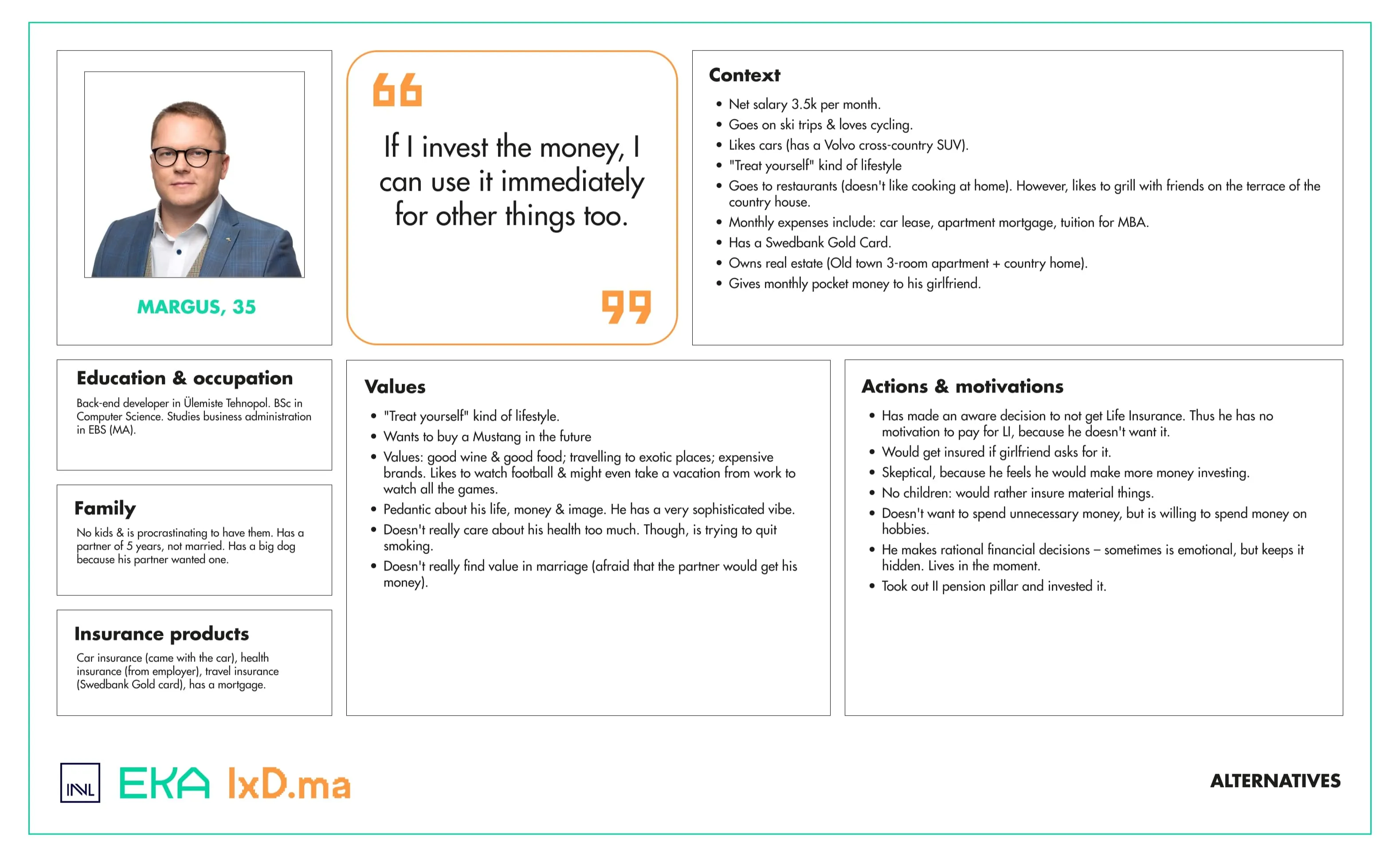

Our persona & his journey

We divided the course into groups of three and started figuring out who the personas are in the life insurance journey. Our team came up with Margus, who is 35 years old and works as a back-end developer. Margus is a person of alternatives – he doesn’t believe necessarily in insurance unless it comes with the products he’s buying. He lives life to the fullest and loves to spend his money.

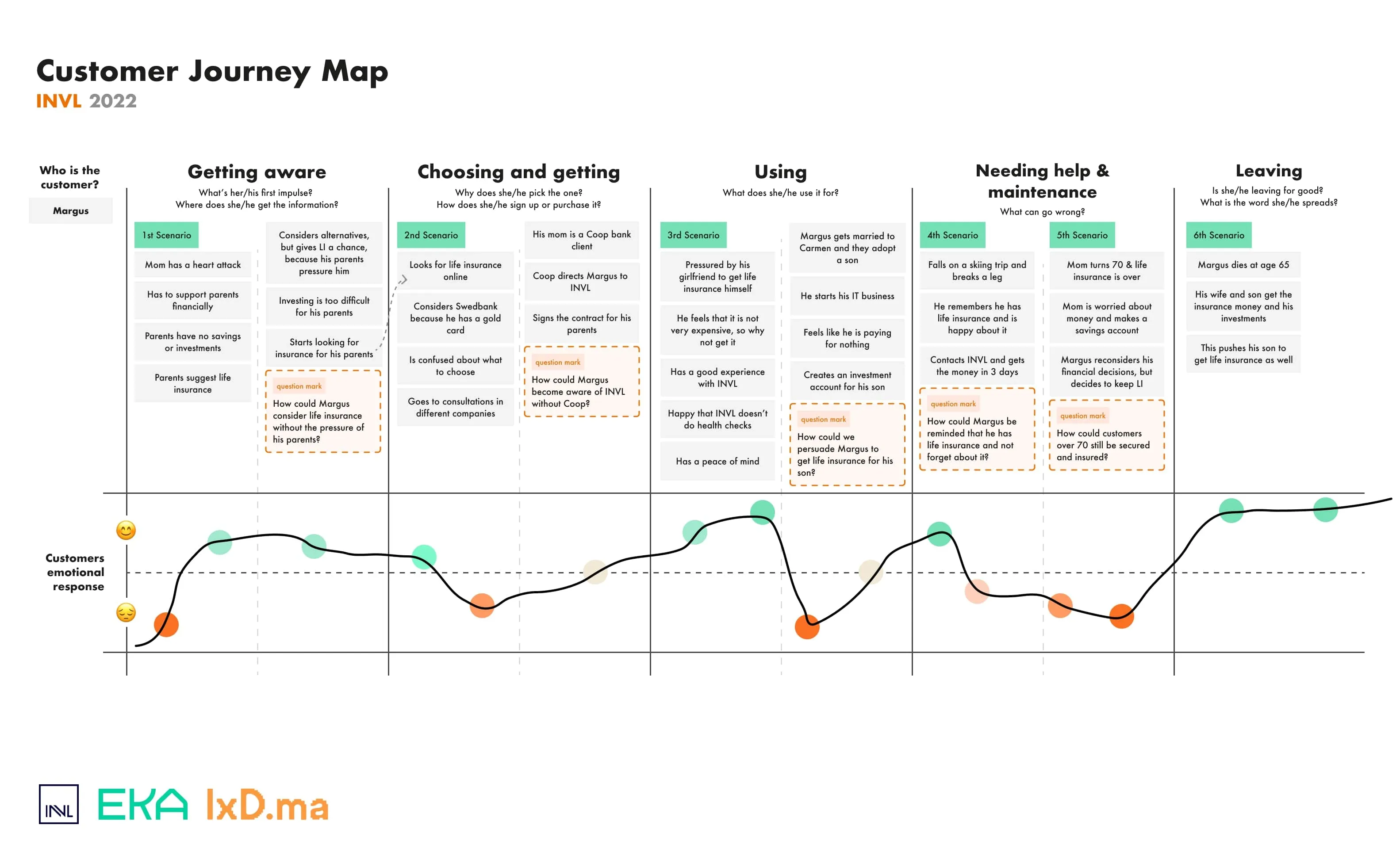

After creating a persona, we also mapped out the user journey for Margus to find the drop-off points in his journey.

Everyone in our team got a point of focus – for me, it was the needing help & maintenance section, where Margus’ mom turns 70 years old, loses her life insurance contract, and all the money she has paid into it for many years.

Developing

Out of the problem mentioned in the previous section, I started with the following “How might we…” question:

How might we ensure that the person feels valued after their contract ends and that their money didn’t vanish into thin air?

As the insurance business relies heavily on getting positive recommendations from current customers, the offboarding process is very important. If the person doesn’t feel valued after they become 70, why would they recommend getting the insurance to others?

During many ideation rounds, I stumbled upon a very weird solution, which I initially thought of as a joke, but which turned out to be a very real idea.

Solution

Give the customer back all the money they’ve paid.

It might sound crazy from a business perspective, but it is already being done by some big insurance firms in the U.S., and quite successfully so. Insurance companies usually make a profit by investing the money that they receive from the customers and even if the customer is paid out some amount of it, the insurance firm usually stays in a profit.

I proposed a solution in which they ask their customers for a bit more money each month, and depending on how big their investment margins are, they can then make a profit during the time the customer is paying to the company and then even pay them back the money if possible. This means that the insurance becomes a savings account for people. To explain and illustrate the idea, I presented a wicked Excel sheet.

And, of course, who wouldn’t love to get an envelope full of cash for their time as a pensioner?

After the presentation, I immediately saw interest from INVL towards this idea; got an A for the course and finished the year with a smile on my face.